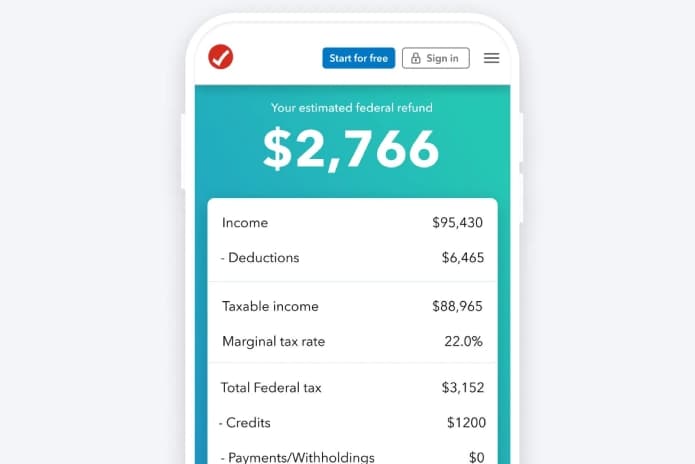

Turbotax 2024 Tax Calculator Estimate Form – You’ll pay a higher price for underpaying estimated taxes. The IRS has raised its penalty interest rate for individuals, to 8% per year. This penalty is assessed for underpayment or late payment of . You may qualify for free federal tax filing through the Internal Revenue Service in 2024. Here’s what to know. .

Turbotax 2024 Tax Calculator Estimate Form

Source : turbotax.intuit.com

Tax Calculator: Return & Refund Estimator for 2023 2024 | H&R Block®

Source : www.hrblock.com

Tax Calculator Tax Refund & Return Estimator 2023 2024

Source : turbotax.intuit.com

Tax Calculator ☆ Estimate Your 2023 Taxes during 2024.

Source : www.efile.com

2023 and 2024 Child Tax Credit: Top 7 Requirements TurboTax Tax

Source : turbotax.intuit.com

Bonus Tax Calculator: Estimate Federal Tax Withholding The

Source : blog.turbotax.intuit.com

2023 and 2024 Child Tax Credit TurboTax Tax Tips & Videos

Source : turbotax.intuit.com

Tax Calculators Archives The TurboTax Blog

Source : blog.turbotax.intuit.com

What is IRS Form 1040 ES: Estimated Tax for Individuals

Source : turbotax.intuit.com

Top 5 Tax Refund Calculators to Ease Tax Refund Estimate Process

Source : pdf.wondershare.com

Turbotax 2024 Tax Calculator Estimate Form Free Tax Calculators & Money Saving Tools 2023 2024 | TurboTax : The IRS’ W-2 is the primary tax form for most working Americans. But what should you do if you don’t receive one? . The U.S. income tax is a pay-as-you-go system. The law requires most employees and self-employed business owners to pay at least 90% of their taxes long before the April due date, which for 2023 .